[ad_1]

One of the great claims of the World wide web — a democratic, clear, open network that would disintermediate entrenched industries, eliminate price-having middlemen and therefore lessen the costs of products — has seemingly been realized.

Priceline and Expedia typically killed travel brokers Prosper and Avant are speedy disrupting financial institution loan officers and the automobile salesman has been diminished in favor of eBay, Autotrader and Craigslist.

And nevertheless, just as absolutely as we imagined they have been long gone for superior, middlemen have arrive surging again to life — rebranded as our greatest mates: the own concierge.

Circumstance in position, own consumers have been after a luxury — a signal of elite class and prestige. No longer: Hundreds of countless numbers of shoppers are now communicating with own stylists (or information-pushed human/synthetic intelligence hybrids) by means of up coming-gen trend platforms such as Trunk Club and Sew Repair — two platforms with demonstrative value (Trunk Club was acquired more than a year in the past for $450 million, and couple experts would reject Sew Fix’s $three hundred million current valuation).

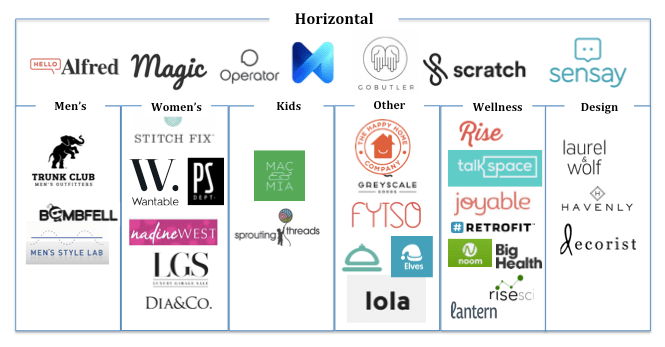

And though trend is an noticeable use situation, the concierge overall economy is thriving, spanning verticals from wellness to style and design, with a total host of wide-based horizontal concierge services also making an attempt to impress their well worth.

Et Tu, Amazon?

The sensible query is: why? Given all the benefits of a frictionless, democratic actively playing area, why are concierge services instantly surging in reputation? I see 3 possible explanations: Amazon, way too many SKUs and shopper acquisition.

Amazon. If you offer nearly any bodily superior on the web, Amazon, the Internet’s most impressive retailer, is a perpetual menace. With their distribution, leverage and logistics know-how, they have the wherewithal to undercut on price tag, and system and supply items a lot quicker than nearly any startup — not to mention, they can function at a loss if essential.

So the place is Amazon exposed? On a services level.

Amazon’s running margins — already limited at 1.3 percent — don’t allow for considerably room to train and mobilize a big human concierge pressure. Which implies that developing a human-targeted, partnership-pushed personalization platform basically presents for a tangible differentiator versus Amazon — 1 of the couple approaches to properly compete versus the huge (and, probably more importantly, 1 of the couple approaches to build defensibility in a commerce phase customarily dependent on “brand” as its only de facto moat).

One further position: Amazon is predominantly a location for directed search – possibly on a specific merchandise or specific class foundation. But as paying for progressively shifts to cellular, it turns out that it proceeds to be challenging to search, find out and catalogue individual things. Concierges – specially when leveraged by means of a cellular interaction position – minimize that friction and enable a new paying for habits.

Much too Many SKUs. We exist in a earth of overwhelm. That overwhelm by means of multi-tasking is impacting how we learn and think, and the overwhelm by means of optionality and availability of details is also impacting how we system, “shatter[ing] focus” and deferring selection producing as extended as achievable.

The trouble of details overload was at first solved by means of curation, the mid-position on the spectrum in reduction of cognitive sounds:

But based on the hyper-development of concierge-facilitated platforms, it seems that curation doesn’t go much plenty of for the emerging established of millennial prospective buyers — they desire even more guidance and personalization than ahead of.

The query operators and buyers should be asking is not irrespective of whether shoppers are connecting with digital assistants, but relatively, at what point will we basically purchase way too many? Therein lies the menace of repeating the cycle of cognitive overwhelm and forcing the up coming iteration of the operator/shopper partnership.

Customer Acquisition. One of the curiosities of the concierge resurgence is that it could have opened the doorway for the up coming technology of shopper acquisition.

The middlemen — when incentivized by means of a fork out-for-efficiency model — basically turn into de facto shopper acquisition brokers for the business, serving as outbound salespeople. Trunk Club was 1 of the innovators of this model and our portfolio business, LGS, has leveraged it with great good results.

The concierge model is formulated as an expert/newbie partnership.

It replicates considerably of the electricity/incentives of a multi-level-advertising (Multilevel marketing) model, devoid of the pyramid-like upfront funds commitments and obligations. Multilevel marketing is a impressive model (Herbalife is 1 example), but social selling can deliver abusive aggressiveness, weak shopper interactions and minimal return-obtain premiums. The concierge model is as a substitute formulated as an expert/newbie partnership.

A concierge-turned-salesperson model is not a suit for all verticals, and it also can not be as effectively-leveraged by hybrid AI assistants. But it does remedy some of the scalability concerns that most consumer enterprises practical experience after regular digital channels (Fb, Google) get started underperforming.

The Dying Of The Community

Until eventually recently, there was a strong speculation that a thriving, energetic neighborhood would unlock an unprecedented skill to facilitate indigenous transactions. Andreessen Horowitz Standard Companion Chris Dixon, when asserting his investment in Soylent, noted:

“He [John Borthwick] said he was fascinated in firms that look to be targeted on selling X but are really on the web communities that transpire to make dollars selling X. This aids describe why many buyers are confused by the sustained good results of these firms. One example he cited was GoPro. Many buyers determined not to spend in GoPro since they saw it as a digicam business, and digicam firms generally get promptly commoditized.”

However, buyers who effectively comprehended GoPro saw it mostly as a remarkably engaged neighborhood of sports fanatics, a thing that is really hard for competition to replicate.

And nevertheless, at the very least on a macro scale, the presumed value is really considerably in question.

Past thirty day period, it was described that indigenous invest in advertisements on Pinterest through the getaway season did not fulfill anticipations:

“The business [Pinterest] commenced inserting Buyable Pins into its Apple iphone application in late June, and just added the feature to its Android application in early November. The business states more than 10,000 merchants have joined the method, such as significant stores and brands like Macy’s, Nordstrom, Neiman Marcus, Cole Haan and Tory Burch, but at the very least 1 of these significant partners is seeing less than 10 purchases a day on Pinterest, according to a person with immediate knowledge of the sales figures. This source and a further also explained that Pinterest insiders have privately admitted to remaining disappointed with early sales numbers.”

In accordance to the exact report, outcomes are likewise disappointing at Twitter and Fb. One-time startup darling, neighborhood-leveraged browsing portal Polyvore was acquired by Yahoo in 2015 for $two hundred million — a healthy price tag to be certain, but definitely lessen than after hoped.

Even GoPro, noted by Dixon as a neighborhood outlier, has lost practically 75 p.c of its company value in the public markets over the past twelve months. Real, it trades at a top quality to commodity makers, but it seems its neighborhood paying for could not be as strong as after imagined.

Transactional communities with more vertical specificity outperform bare-bones e-commerce.

Nevertheless, transactional communities with more vertical specificity (such as Soylent) outperform bare-bones e-commerce. And it is plainly the really early innings in Pinterest and Twitter’s endeavours to offer items instantly by way of their platforms. Do not be shocked to see the larger horizontal neighborhood gamers keep on to battle, and in the end purchase firms in the concierge house in order to strengthen their conversions, order dimensions and frequency.

The Economics

The upside of human-pushed assistant/concierge services is that in most scenarios, they include value to an conclusion-user practical experience. The downside is that they include content costs to a company’s P&L.

Get, for example, any of the stated wellness applications (Increase, Talkspace, Big Health, etc.), which, if operated on a purely software foundation would boast eighty-90 p.c gross margins. But a human-targeted element impacts that in 1 of two approaches:

- The business employs (W2s) any selection of wellness professionals who are anticipated to interface with a given quota of prospects. Although this model permits the wellness application to preserve their gross margins, it cuts deeply into their contribution margins since of the extra labor price.

- The other option is to view the wellness professionals more like marketplace suppliers, and hook up them to prospects on a 1:1 foundation, though having to pay them a share of just about every transaction (say 70 p.c). Though this does have the result of eradicating the wellness experienced costs from the G&A line, it also adjustments the mother nature of the small business — from a 90 p.c margin software small business to a marketplace model with a 30 p.c take-rate.

Given those two alternatives, it’s clear why a hybrid AI/device understanding model is the holy grail for various verticals — replicating the level of personalised provider though minimizing overhead labor costs and preserving remarkable software-level gross margins.

That explained, it is nevertheless unclear if hybrid AI assistants can deliver an conclusion-user practical experience impressive plenty of to materially have an impact on paying for, conversion and frequency.

For the time remaining, within just the totally human-run services, the successful small business products will be ones that can retain the services of somewhat affordable, untrained people who can then be empowered by means of software or leveraged workflows to supply a meaningfully enhanced conclusion-user practical experience.

This has the added advantage of yielding increased offer/expert-aspect scalability, in that the pool of possible concierges is much larger (if efficiency does not call for deep know-how) and the level of regularity, even throughout know-how stages, will be more secure.

Startups making an attempt to wedge into the market making use of a high level of provider require to be remarkably cognizant of, and targeted on, managing costs. Specially as the trader market proceeds transitioning away from high funds burn off products, obsessive attention on how to supply a high-high-quality practical experience, deepening extended-expression scalability and leveraging lessen-price tag labor will yield many persuasive outcomes.

Disclosure: Chicago Ventures is an trader in LGS, Mac&Mia, Increase Science, Retrofit and Havenly.

Highlighted Graphic: Bryce Durbin

Browse More Right here

[ad_2]

The Intermediary Strikes Back

No comments:

Post a Comment