[ad_1]

Amazon posted its first-quarter earnings today, and boy did they not disappoint: it beat what analysts were being anticipating on approximately all fronts, and the inventory is up extra than twelve% immediately after its large beat.

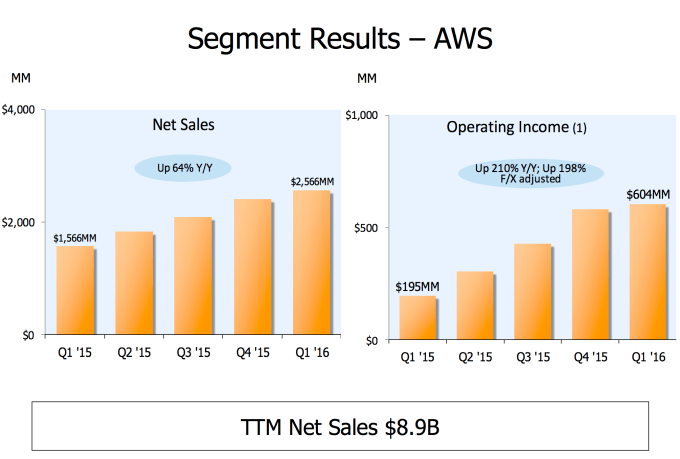

The significant 1 listed here, in unique, is Amazon World wide web Expert services. AWS has develop into a go-to for most companies, so it’s not stunning that it’s viewing that phase continue to increase steadily. The firm is publishing large 12 months-around-12 months progress listed here, meaning that need is however increasing, despite increasing opposition from providers like Google. A lot more and extra, it seems to be like AWS is going to be a large 2nd line of business for the firm, in particular if it proceeds to increase at this price. For the trailing twelve months, it’s about a $nine billion business.

It’s always extraordinary for a firm that, for most of its lifetime, has been concentrated totally on its commerce facet is in a position to increase a new business from scratch, supplied that other larger sized technological know-how providers are also throwing ideas at the wall seeking for new strains of business. For Facebook, it’s VR and services like WhatsApp. For Google, it’s the company’s moonshots like self-driving cars and trucks. These have however to arrive to fruition, when AWS is demonstrating that it’s getting a true business.

Even extra apparently, Amazon’s AWS division posted an working income even better than its main business in North America. The firm claimed AWS posted an working income of $604, when compared to working income of $588 in its main business in North America. This is a business that, when producing fewer than its e-commerce business, looks at first blush operationally extra effective and however expanding at a health and fitness price. Bezos himself claimed that he expects AWS to be a $ten billion yearly business in his 2015 letter to shareholders.

Here’s the scorecard:

- The firm noted earnings of $one.07 for each share, ahead of fifty eight cents for each share that were being anticipated. The firm posted a internet reduction of twelve cents for each share in Q1 2015.

- Earnings was $29.13 billion, ahead of what $27.ninety eight billion that analysts were being anticipating, and up 22% from the same quarter last 12 months.

- Amazon net services profits was up to $two.57 billion — ahead of the $two.fifty three billion that analysts were being anticipating. That is up from $one.57 billion in the same quarter a 12 months back, a soar of about sixty four%.

- The firm sees Q2 profits of $28 billion to $thirty.five billion.

- Unearned profits came in at $three.seventy seven billion, up from $three.twelve billion in the former quarter.

- Technological know-how and articles profits was $three.five billion, up from $two.eight billion in Q1 2015.

- Worldwide sales of $nine.6 billion, up from $7.eight billion in the same quarter a 12 months back.

So the firm is around-performing when compared to what all people anticipated in approximately each and every class. Amazon is increasing into tons of new markets, like video clip streaming and increasing its net services business, and of training course it has its $ninety nine for each 12 months Key membership. The firm is also increasing its portfolio of gadgets with the Fireplace Television and the Amazon Echo.

What’s going on listed here with the inventory? Fundamentally, Amazon shares are likely to swing wildly any time it reports earnings. Very last quarter shares tanked 13% immediately after missing fourth-quarter anticipations. The 12 months in common has been a rocky 1, nevertheless it’s been 1 of the much better-performing stocks of the 12 months (it’s up forty two%). So it’s not stunning to see these a significant swing off today’s earnings immediately after it posted these a prosperous quarter.

One significant 1 traders are seeking at is directional details about the company’s Amazon Key memberships. In theory, generating it less difficult/more affordable to deliver points really should convince buyers to obtain extra, outweighing the amplified transport fees that the firm would sustain. This, in theory, falls below unearned profits, which appears to be at any time-increasing.

There’s an additional significant craze this earnings report establishes: Amazon has posted a financial gain for four quarters straight. The firm has historically been really blasé about focusing on financial gain, as an alternative investing totally in progress and demonstrating losses on a regular foundation, but the firm now appears to be turning its business into a successful machine (or at the very least, focusing on that to some extent).

As typical, Amazon didn’t break out any new numbers for its hardware gadgets — despite launching a new Kindle (the Kindle Oasis) and two new Amazon Alexa-driven gadgets.

As typical, Amazon didn’t break out any new numbers for its hardware gadgets — despite launching a new Kindle (the Kindle Oasis) and two new Amazon Alexa-driven gadgets.

We’re updating this publish with extra details as it arrives in

Featured Graphic: Eric Broder Van Dyke/Shutterstock

Read through A lot more Below

[ad_2]

Amazon’s World wide web Expert services are shining in its hottest earnings beat

-------- First 1000 businesses who contacts http://honestechs.com will receive a business mobile app and the development fee will be waived. Contact us today.

#electronics #technology #tech #electronic #device #gadget #gadgets #instatech #instagood #geek #techie #nerd #techy #photooftheday #computers #laptops #hack #screen

No comments:

Post a Comment