Intel wishes to offer its McAfee security organization, which was acquired for $seven.seven bn in 2010. And Symantec just acquired Blue Coat for $four.seven billion.

As the security market shakes up in more strategies than one particular, who wins, who struggles and who will get acquired following?

“The Symantec-BlueCoat transaction is the next biggest M&A transaction in background for enterprise security. The security market chessboard is evolving suitable ahead of us,” mentioned Eric McAlpine, Founder of Momentum Associates, a Silicon Valley based mostly M&A advisory firm with a very long checklist of security offers.

“Symantec has paid handsomely to make a major move to preserve its place as a leader in the area. Although the headline cost was certainly complete by money standards, it was the offer framework that was more fascinating, with solidarity and aid by two really clever non-public equity firms with deep expertise investing in security,” McAlpine mentioned.

Intel’s acquisition of McAfee for $seven.seven billion in 2010 is the biggest security transaction to date. However, the sale of Intel’s security organization would not likely fetch $seven.seven billion currently by any measure.

PE cash with an edge in security – Thoma Bravo, Bain Capital and Vista Equity Associates – may well gain as the security chessboard shuffles. Vista Equity Associates just acquired Ping Id and Blue Coat was a PE playground of sorts. Blue Coat was bought, offered, and bought all over again by PE firms (and lastly offered it again…to Symantec) with every firm generating out well with every flip.

Blue Coat Acquirer

|

Transaction Year

|

Blue Coat Acquisition Value

|

Blue Coat Revenues

|

Various of Earnings (EBITDA)

|

Thoma Bravo

|

Dec 2011

|

$1.three billion

|

$467.1 million

|

two.1x (14x)

|

Bain Capital

|

Mar 2015

|

$two.four billion

|

$650 million*

|

three.7x* (N/A)

|

Symantec

|

June 2016

|

$four.seven billion

|

$755 million

|

seven.8x (21x)

|

(Source: 451 Exploration. *Believed based mostly on multiples)

Bain Capital almost doubled their entry benefit in just around a year. Although Bain has agreed to roll around $750 million back again into the organization, they are now participating in with house dollars. Bain Capital’s timing for market consolidation was location on and their expenditure has paid off handsomely. By all accounts, Symantec has paid a significant cost to continue to be applicable. Which begs the question…does ‘yellow’ and ‘blue’ make eco-friendly ($$$) for this tie up?

Symantec’s all round organization has largely been driven by its Norton AntiVirus consumer security suite, which fetches approximately 50% of its revenues or $1.nine billion yearly. But Norton is a shrinking brand in a battling market as customers have flocked to totally free or freemium choices by AVG, AVAST, Malwarebytes, etcetera. The other half of its earnings arrives from Symantec’s enterprise security choices, which largely consist of endpoint protection and details reduction avoidance.

With Blue Coat less than its belt, Symantec receives a missing and a great deal needed world wide web and cloud security item portfolio. Symantec can now bring an integrated enterprise suite of choices for world wide web, e-mail, endpoint, cloud, and community security, albeit some of Blue Coat’s items are not as bleeding edge. Blue Coat itself has developed by acquisition and consolidation. The organization closed 11 acquisitions for almost $400 million in total because 2007.

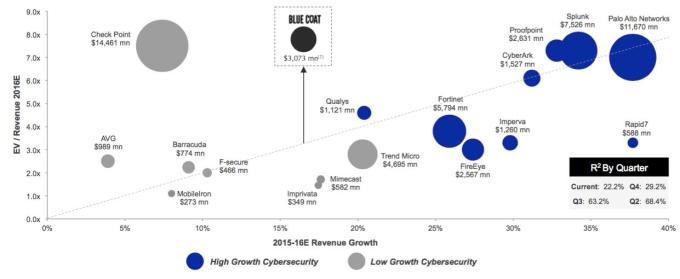

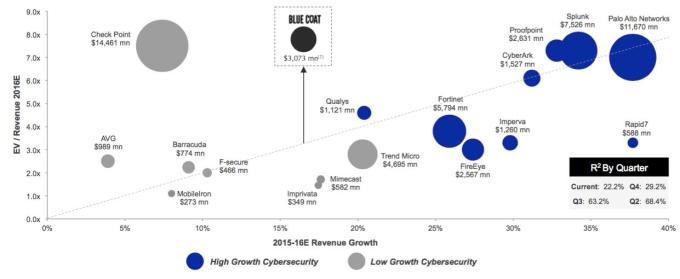

Value = Submit dollars of the final round Revenues + Growth price + “X”

As the markets soften and consolidations get started, acquirers are not searching just at the article-dollars of the final funding round. “The M&A markets benefit a blend of market leadership, earnings expansion, predictability, and scale,”says McAlpine. “In our study, the correlation of earnings expansion to benefit by yourself is currently a mere 22%, which is traditionally very low as valuations have historically correlated a great deal greater (70%+) to prime line expansion. It’s as clever as ever to decide benefit in the context of M&A as one particular must take into account a selection of components outside of just expansion.”

Momentum Partners’ study of the Symantec / Blue Coat transaction highlights the benefit drivers of customers-sellers and benefit drivers of security acquisitions.

Correlation of Enterprise Value / Earnings & Earnings Growth for Public Safety Distributors (Source: Momentum Associates, June 2016)

Who’s Future In Line To Be Acquired?

When we choose a challenging glimpse at the top security suppliers like Cisco, IBM, Microsoft, and HP, every has used M&A to a distinctive extent to continue to be atop the security leader board.

Cisco has put in north of a billion pounds in the past 12 months to increase risk protection and community conduct evaluation with the 2015 acquisitions of OpenDNS ($660 million) and Lancope ($453 million) offering Cisco a head get started.

Cisco is also priming up its security solutions organization with acquisitions like Portcullis and Neohapsis. Cisco’s intense security M&A posture dates back again to 2013 with the $two.seven billion acquisition of Sourcefire at ~11x trailing twelve months revenues generating it the 4th biggest security transaction (3rd at the time) in background and one particular of the priciest at its scale.

So what’s following for Cisco? Need to Cisco prolong from its main networking security roots to the endpoint? Cisco has been rumored to kick the tires on FireEye as have some other folks. Other noteworthy endpoint players contain disruptive Cylance, which lately earned its horn and unicorn standing increasing $one hundred million, as well as Tanium, CarbonBlack, and Invincea.

Or, will Cisco glimpse to move away from components and jump into world wide web gateways? Morgan Stanley and Gartner estimate that cloud security will outpace on-prem expansion by orders of magnitude. Cloud security is developing at 19% CAGR for the following four yrs as compared to a three% CAGR for on-premise methods.

Cloud Safety Spend is Increasing at a 19% CAGR (Source: Gartner, Morgan Stanley Exploration)

The prime three firms in Gartner’s Magic Quadrant for Safe World wide web Gateway are Zscaler, Websense (now Forcepoint), and Blue Coat. With two of the three now acquired (Websense was acquired for $1.nine billion by Raytheon in 2015), the shortage benefit raises for Zscaler, which is formidable cloud participant and a top M&A goal. Symantec was rumored to be mulling an acquisition of Zscaler before this year.

Appliance suppliers will be applicable for the foreseeable potential, but cloud incumbents are significantly a major risk. Palo Alto Networks potential customers the Future Gen Firewall (NGFW) market and its expansion price has been really sturdy, albeit showing symptoms of deceleration lately. Palo Alto has applied M&A as a device to prolong outside of the community with its acquisitions of CirroSecure (cloud) and Cyvera (endpoint). CirroSecure gives it an edge in the crowded Cloud Obtain Safety Brokers (CASB) area, although independents SkyHigh Networks and Netskope are fighting to attain a bigger slice of the CASB pie. Two other noteworthy CASB suppliers had been acquired final year (Elastica acquired by BlueCoat for $280 million and Adallom acquired by MSFT for $290 million) offering every an early exit and major payday to their founders and buyers.

The Endpoint However Issues.

Although enterprise endpoint protection seems antiquated, it however garners decent revenues for the likes of Intel Safety (formerly McAfee) and Symantec. Innovators like Cylance and Crowdstrike, both of those valued earlier mentioned a billion pounds, are tackling the endpoint security issue in novel (non-signature based mostly) strategies. Tanium has positioned itself as Endpoint Devices Administration and is rumored to have turned down bids from VMWare and Palo Alto Networks.

The ‘Insider Threat’ & Behavioral Safety Will get Consideration.

A new emerging security category regarded as Person & Entity Actions Analytics (UEBA) is tackling the insider risk issue (imagine Snowden) as well as anomalous community and endpoint conduct previously undetected by current security methods. Founders and VCs have taken see launching and funding a wave of get started-ups like Fortscale, Exabeam, RedOwl, and Securonix poised to choose advantage of this rapidly growing phase within just security. Gartner predicts M&A fever for UEBA suppliers in 2016 soon after the shock acquisition of Caspida by Splunk ($a hundred ninety million) final year.

Tying this back again to the endpoint, the endpoint is poised to become contextual with identities, apps and person conduct styles, which will drive consolidation within just the endpoint, software and security analytics suppliers. The larger firms like IBM, Intel, Dell+EMC, HP, and CA will have to increase their portfolios with the innovators to continue to be applicable as know-how normally takes leaps ahead.

Id Would make A Comeback.

Id and Obtain Administration (IAM) has witnessed the likes of Okta, SailPoint, Thycotic, and Auth0 generating waves in this phase, together with Ping Id acquisition by Vista Equity. But what does Id even suggest in this day and age? And who cares? Compliance has been a driver for IAM adoption yet they are being pushed to produce more. One Sign On (SSO) and physical Two-Aspect tokens do not necessarily lower it any longer.

Social identities derived from Google and Facebook are growing the require for more comprehensive following-gen methods. Adaptive IAM and job-based mostly obtain handle is rapidly developing despite the fact that financial benefit stays a obstacle. With EU details residency policies coming into outcome, we will see more chances arise. Vital Administration will be integral choices at the infrastructure layer. Obtain handle to apps and solutions in dynamic environments is an chance that has yet to be tapped in a significant way. Okta has reportedly employed Goldman Sachs to get ready for an IPO. Will they opt for the Blue Coat route and offer rather?

Automate and Orchestrate, Or Else.

The expansion of stage methods, integration / coverage worries and lack of talent will drive the require for automation resources. By 2019 there will be a require for six million security industry experts predicts (ISC)two, but only four.5 million will have the necessary skills for individuals work opportunities. Earlier this year FireEye was initially to pull the M&A set off and acquired Invotas, which has become their orchestration hub to support with security crew fatigue. Various other startups are rapidly developing automation / AI choices.

Underneath is a glimpse at some of the major security segments and their incumbents who must continue to be applicable by item development and/or M&A. In the meantime the innovators are searching to disrupt them rapidly.

Safety Phase

|

Incumbents

|

Innovators

|

Community Safety

|

Cisco, Checkpoint, HP, Fortinet, Palo Alto Networks, FireEye

|

Forescout, Protectwise, Venafi, Tempered Networks, RedSeal

|

Endpoint Safety

|

Symantec, AVG (Client), Intel McAfee (Enterprise), IBM, Pattern Micro, FireEye

|

Cylance, Crowdstrike, Carbon Black, Tanium, Cybereason, Invincea, Morphisec, Lastline

|

Software Safety

|

Imperva, Qualys, Rapid7, IBM, HP, Veracode

|

Prevoty, Synack, WhiteHat Safety

|

World wide web Safety

|

Blue Coat, Cisco, Forcepoint, Intel, Barracuda Networks

|

Zscaler, iboss, Form Safety, Distil Networks

|

Safety Functions & Incident Reaction

|

Splunk, IBM, Intel, HP, LogRhythm, EMC/RSA

|

AlienVault, Skybox Safety, DFLabs, Sumo Logic

|

Specialised Risk Analysis & Security

|

Intel, IBM, HP, Symantec, FireEye

|

Fortscale, Sqrrl, RedOwl, Exabeam, E8 Safety

|

Id & Obtain Administration

|

Oracle, CA, EMC/RSA, IBM, CyberArk, Ping Id

|

Okta, Auth0, onelogin, Thycotic, SailPoint

|

Info Safety & Info Loss Prevention

|

Symantec, Intel, Forcepoint

|

Digital Guardian, Id Finder, Datashield Defend, Code42

|

Cloud Safety

|

Cisco, Test Issue, HP, Microsoft

|

Skyhigh Networks, vArmour, Netskope, CipherCloud, Dome9

|

Outside of The Classic Buyers

As the following wave of security improvements happen, we will see underlying trends of deep studying & automation integral to the bleeding edge items. Cloud security, details security and VM / microservices security are developing groups in and of them selves, and beneath it all, and DevSecOps is a new issue presently.

These newer segments will build new chances, which in change will bring new attention by new and traditional acquirers alike. Cloud / details centre suppliers like AWS and Microsoft will make out their portfolio as the market grows. The Telcos are pushing for a slice of this pie. SingTel’s $800 million Trustwave acquisition is indicative of this pattern as was NTT’s acquisition of Solutionary. And while defense contractors have a checkered background in security, they recently have gotten hot for the sector together with Raytheon (by way of Websense/Forcepoint), Thales (acquired Vormetric for $400 million) and BAE Devices (acquired SilverSky for $233 million) to make up their security choices.

And The Winners Will Be…

Cisco clearly is forward of the pack in this security chess activity. Symantec just bought a new existence line. Or it bought a CEO for $four.seven billion dependent on how you glimpse at it. And Greg Clark is no stranger to acquisitions so it’s predicted that Symantec will carry on its procuring spree when the dust settles.

In another corner, IBM – the Even bigger ‘Blue’ – is beset with its possess worries and moves slowly and gradually, but has a dollars war chest and its possess spectacular multi-billion dollar M&A observe record in security (ISSX, Q1 Labs, Trusteer). It most lately acquired Resilient Devices to reinforce its Automation & Incident Reaction capability. However the organization has some ground to protect. Its Watson AI meme could enjoy out if it can get its act alongside one another.

Even as Intel receives out of the organization, HP and Juniper have been largely unable to respond in any sizeable way. The former undergoing a major company transformation and the latter being largely silent in security M&A because their acquisition of Netscreen. Juniper acquired Netscreen in 2004 for a whopping $four billion, generating that however the 3rd biggest security offer of all time.

And then there is Microsoft who had traditionally had a horrible record in security less than prior CEOs. Nonetheless, Satya Nadella says no more. Microsoft has fully commited to expend $1 billion yearly on a ‘holistic’ security tactic. This consists of acquisitions, hiring new execs, developing a new point out of the artwork facility, and creating a new security team within just Microsoft.

However the elephant in the home is clearly Amazon. The ‘AWS effect’ on security is profound and firms like vArmour have taken advantage. Amazon has developed up its possess portfolio of primary security resources (such as AWS WAF, CloudHSM, Cloudwatch and IAM) largely by partnerships and in parallel produced an AWS security marketplace of around 200 security suppliers.

It’s a outstanding enjoy. Amazon will gain no make a difference how the suppliers thrive, survive or crash and melt away. Other firms like Intel may divest, some will overpay, purchase, combine, and disintegrate although AWS will laugh its way to the financial institution. In this $seventy five billion market developing to $one hundred seventy billion by 2020, the winner’s circle will increase outside of just PE firms.

(The creator gratefully acknowledges the crew at Momentum Associates for furnishing details and study for this article.)

Browse Much more Here

[ad_2]

As Symantec flexes its muscle in security, who will action up to the obstacle?

-------- First 1000 businesses who contacts http://honestechs.com will receive a business mobile app and the development fee will be waived. Contact us today.

#electronics #technology #tech #electronic #device #gadget #gadgets #instatech #instagood #geek #techie #nerd #techy #photooftheday #computers #laptops #hack #screen

No comments:

Post a Comment